Making a budget is key to financial success. But, let’s face it: no one wants to sit down and manually calculate their monthly expenses. Moreover, anyone who has ever taken out a loan knows that the monthly payment is one of the most important factors in determining how much you can afford to borrow.

But for many people, calculating monthly payments is a mystery. If you’re one of those people, never fear! Excel can do the math for you. Whether you’re trying to manage your finances and want to know exactly how much your mortgage will cost each month.

Or you’re looking to buy a new car and need to figure out what kind of monthly payment you can afford. Regardless of the reason, Excel is a great tool for calculating monthly payments.

And once you know how to do it, it’s actually not that difficult. For instance, being able to calculate monthly payments in Excel can come in handy in a variety of situations.

What is PMT Function in Excel

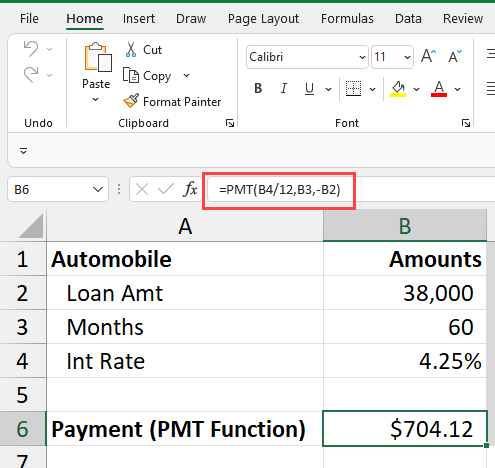

The PMT function is a built-in function in Excel that is categorized as a financial function. It can be used to calculate the payment for a loan based on constant payments and a constant interest rate.

The syntax for the PMT function is:

PMT( rate, nper, pv, fv, type)

Where:

- Rate: The interest rate for the loan.

- Nper: The total number of payments for the loan.

- Pv: The present value of the loan; also known as the principal.

- Fv: The future value of the loan, or zero if you want Excel to calculate it for you.

- Type: The number 0 or 1, where 0 indicates that payments are due at the end of the period and 1 indicates that payments are due at the beginning of the period.

How to Use PMT Function in Excel – Different Conditions

Now that we know what the PMT function is and what each of its arguments represents, let’s take a look at how to use it in Excel under different circumstances with some examples.

Condition 1: Calculating the Payment for a Loan – Conventional Method

Here we’re gonna explain to you how to calculate a payment for a loan using the most used method with the help of an example, so let’s have a look

Suppose you take out a loan for $10,000 at an interest rate of 5% with a term of 60 months. In this case, your monthly payment would be $188.71.

You can calculate this in Excel using the PMT function as follows:

=PMT(5%/12,60,-10000,0,0)

The result is -188.71, which is the monthly payment for the loan.

Note that the interest rate is entered as 5%/12 since the interest rate is given as an annual percentage rate (APR) and we want to calculate the monthly interest rate.

The negative sign in front of the result simply means that the payment is an outgoing payment; in other words, you’re making a payment on the loan each month.

Condition 2 – Calculating the Payment for a Loan with a Down Payment

Now let’s suppose you’re taking out a loan for a car that costs $20,000.

You have a down payment of $4,000, so the amount you’re borrowing is $16,000.

The interest rate on the loan is 6% and the term is 60 months. In this case, your monthly payment would be $329.69.

You can calculate this in Excel using the PMT function as follows:

=PMT(6%/12,60,-16000,-4000,0)

The result is -329.69, which is the monthly payment for the loan.

Note that we have included the -4000 for the fv argument since we are making a down payment on the loan.

If you didn’t make a down payment, you would simply omit this argument or enter 0 for the fv argument.

Condition 3 – Calculating the Payment for a Loan with Additional Payments

Suppose you’re taking out a loan for $10,000 at an interest rate of 5% with a term of 60 months. In this case, your monthly payment would be $188.71.

However, suppose you want to make an additional payment of $50 each month. The Excel PMT function can’t calculate the new monthly payment since it only takes into account the original loan amount, interest rate, and term.

Instead, you would need to use the NPER function along with the PMT function to calculate the new monthly payment.

Benefits of PMT Function in Excel

The PMT function is a quick and easy way to calculate the monthly payment for a loan in Excel.

It’s also a useful function to know if you’re trying to create a budget or financial plan. For instance, if you’re trying to figure out how much you can afford to spend on a house, you can use the PMT function to calculate the monthly payment for different loan amounts, interest rates, and terms.

This can help you narrow down your search to houses that fit within your budget.

Conclusion

There you have it! A step-by-step guide on how to calculate monthly payments in Excel. This method is simple, easy to follow, and accurate. So whether you’re trying to figure out how much your car payment will be or determine your mortgage payment, Excel has you covered. And now that you know how to do it, just fire up Excel and let it do the math for you.