In the ever-evolving landscape of finance and investments, the ability to calculate Compound Annual Growth Rate (CAGR) is an essential skill. CAGR serves as a powerful metric for assessing the performance and growth potential of various financial assets, such as stocks, bonds, and investment portfolios.

In this comprehensive guide, we, as seasoned professionals in the field of finance, will walk you through the intricate process of calculating CAGR in Microsoft Excel. By the end of this article, you will not only understand the concept of CAGR but also be equipped with the expertise to perform calculations effortlessly.

What is CAGR?

Before diving into the calculations, let’s get a firm grasp of what CAGR actually represents. CAGR is a powerful tool used to determine the annual growth rate of an investment over a specified period. It’s especially handy when you’re dealing with investments that experience fluctuations in value.

CAGR smoothens out these fluctuations and provides a single, consistent growth rate. This makes it an indispensable metric for evaluating the performance of investments such as stocks, bonds, or even business revenue.

Why Calculate CAGR?

Understanding CAGR is crucial for several reasons:

1. Assessing Investment Performance

CAGR allows investors to evaluate the historical performance of their investments. By calculating CAGR, you can determine the average annual return on your investment over a specific timeframe.

2. Comparing Investment Opportunities

When presented with multiple investment options, CAGR enables you to make informed decisions by comparing the potential returns of each option on an equal footing.

3. Setting Realistic Financial Goals

By knowing the historical CAGR of an asset or portfolio, you can set achievable financial goals and expectations for the future.

The Formula for Calculating CAGR

Now, let’s get down to the nitty-gritty of calculating CAGR in Excel. The formula for CAGR is deceptively simple:

CAGR = (EV/BV)^(1/n) – 1

- EV: Ending Value of the Investment

- BV: Beginning Value of the Investment

- n: Number of Years

How to Calculate CAGR in Excel

Calculating CAGR in Excel might seem complex, but with our step-by-step guide, you’ll master this skill effortlessly. Let’s dive right in:

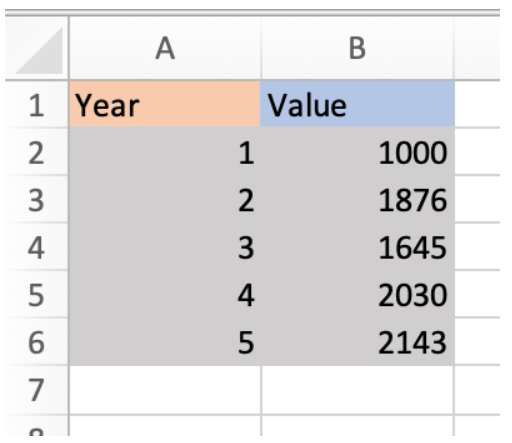

Step 1: Gather the Data

To start, you’ll need to gather the necessary data. Obtain the initial and final values of your investment and note the number of years over which this growth occurred.

Step 2: Input the Data

In your Excel spreadsheet, set up a table with three columns: “Year,” “Investment Value,” and “CAGR Calculation.” Enter the corresponding values for each year.

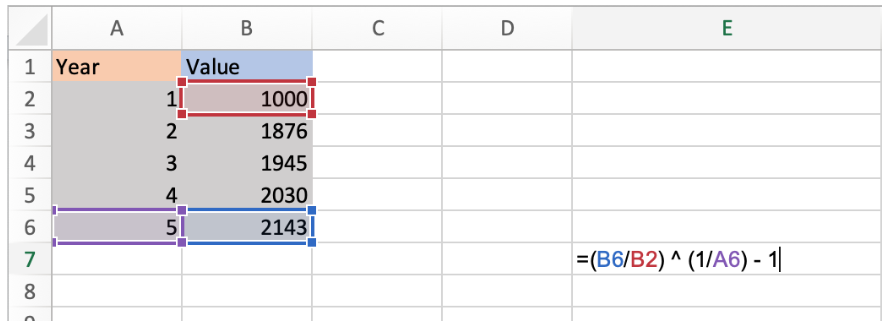

Step 3: Calculate CAGR

In the “CAGR Calculation” column, use the formula mentioned above to calculate the CAGR for each year.

Excel will do the heavy lifting, and you’ll have your CAGR values in no time.

Using CAGR for Informed Decision-Making

Now that you know how to calculate CAGR, you can harness its power for making informed financial decisions. Here are some practical applications:

1. Investment Evaluation

CAGR helps you assess the performance of different investments over the same period, enabling you to make informed choices based on growth potential.

2. Business Growth Analysis

For businesses, CAGR can be used to evaluate revenue growth, making it a valuable tool for strategic planning and forecasting.

3. Risk Assessment

Understanding the historical CAGR of an investment can assist in assessing its risk level. Consistently high CAGR may indicate a riskier investment.

4. Setting Realistic Goals

CAGR provides a realistic view of what you can expect from an investment in the long term, helping you set achievable financial goals.

Conclusion

In this guide, we’ve provided you with a comprehensive tutorial on how to calculate CAGR in Excel. Armed with this knowledge, you can now make more informed investment decisions, track the growth of your assets, and assess the historical performance of your investments accurately.

Remember, mastering financial tools like CAGR in Excel is just one step towards becoming a savvy investor. Continuously educating yourself about financial metrics and staying updated with market trends is crucial for long-term financial success.

So, there you have it—a step-by-step guide on calculating CAGR in Excel like a pro. Start crunching those numbers, and may your investments grow steadily over time!