In the world of finance, mastering the art of calculating Net Present Value (NPV) is crucial. It’s a financial metric used to evaluate the profitability of an investment or project. The ability to calculate NPV in Excel is a skill that can make or break financial decisions. In this comprehensive guide, we will walk you through the steps to calculate NPV in Excel, ensuring you have a solid grasp of this essential concept.

Understanding Net Present Value (NPV)

Before diving into the technicalities, let’s establish a fundamental understanding of NPV. Net Present Value is a financial metric that helps businesses and individuals determine the value of an investment in today’s dollars.

It considers the time value of money, acknowledging that a dollar received in the future is worth less than a dollar received today. NPV is an invaluable tool for assessing the profitability of investments, as it takes into account both the initial investment and the expected future cash flows.

Preparing Your Data

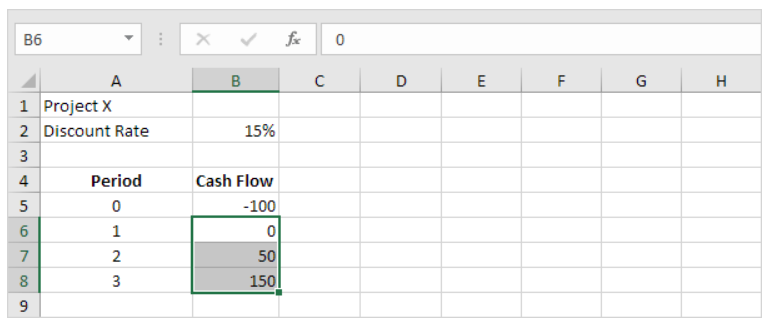

To calculate NPV in Excel, you need to have a clear set of data. Here’s what you’ll need:

1. Initial Investment (Cash Outflow)

The first step is to determine the initial investment, which is the amount of money you need to invest in the project or asset. This initial cash outflow represents the cost of starting the project.

2. Expected Cash Flows

You’ll also need to project the expected cash flows the investment will generate over a specific period. These cash flows could be both positive and negative, representing income and expenses associated with the investment.

3. Discount Rate

The discount rate is a crucial factor in NPV calculations. It reflects the rate of return required to make the investment worthwhile. The discount rate can vary based on the risk associated with the investment.

The NPV Formula

Now, let’s get into the nitty-gritty of calculating NPV in Excel. Excel offers a simple way to do this using the NPV formula:

=NPV(rate, range_of_cash_flows) – Initial Investment

- Rate: This is the discount rate, which you’ve determined based on the risk and required return.

- Range of Cash Flows: Select the cell range that contains the expected cash flows over time. Make sure to include both the initial investment (as a negative value) and subsequent cash flows.

- Subtract Initial Investment: It’s important to subtract the initial investment to arrive at the final NPV value. This is because the initial investment represents a cash outflow.

Using Excel Functions for NPV Calculation

In Excel, you can utilize built-in functions to calculate NPV efficiently. Here are the steps:

- Select the cell where you want the NPV value to appear.

- Go to the “Formulas” tab in Excel.

- Click on “Financial” under the Function Library.

- Choose “NPV” from the list.

- In the NPV dialog box, enter the discount rate as the Rate and select the range of cash flows for the Value arguments.

- Click “OK,” and Excel will calculate the NPV for you.

Interpreting the NPV Result

After performing the calculation, you will get a numeric value as the NPV. Now, let’s interpret the result:

Positive NPV: A positive NPV indicates that the investment is expected to generate more cash than the initial outlay. This is a good sign, as it suggests a potentially profitable venture.

Negative NPV: A negative NPV means that the investment is not expected to generate sufficient cash to cover the initial cost. In general, this signals that the investment is not financially viable.

Making Informed Decisions

Mastering the art of calculating NPV in Excel equips you with a powerful tool to make informed financial decisions. By comparing the calculated NPV to your required rate of return, you can assess the attractiveness of an investment opportunity. A positive NPV suggests that the investment is likely to yield profits, while a negative NPV indicates caution may be necessary.

Factors to Consider

It’s important to note that NPV calculations depend on several factors, including the accuracy of your cash flow projections, the reliability of your discount rate, and the risk associated with the investment. These factors can significantly influence the NPV result, so it’s essential to use realistic and well-researched data.

Conclusion

In the world of finance, understanding how to calculate NPV in Excel is a crucial skill. It empowers you to assess the profitability of investments and make informed financial decisions. By following the steps outlined in this guide, you’ll be well on your way to mastering the art of NPV calculation. Remember that the accuracy of your data and the appropriateness of your discount rate are key to obtaining reliable NPV results.